Real estate is a universal currency, carefully watched by locals of all stripes.

And over the last five years, observers have become accustomed to shrinking inventory and increasing prices after a pandemic surge in homeownership seemed to gobble up every available property from Gloucester to Essex, Manchester, Beverly and beyond. Most activity has come from Millennials, America’s biggest generation, who drove sales of starter homes in towns with great school districts, while retiring Boomers wanted to downsize their big family homes and stay local.

The result? Inventory for residential real estate—land, condos and single-family homes—has been anemic throughout the 23 cities and towns on Boston’s North Shore.

It’s been a proverbial “Catch 22.” Even if a homeowner wants to sell, what (and where) would they buy? Then, 18 months ago the Federal Reserve Bank boosted interest rates to cool inflation, which may have slowed real estate sales, but even 7+% interest rates on mortgages didn’t stop the market.

But a recent shift is giving many local real estate brokers relief.

According to data released by the Beverly-based industry group, North Shore Realtor Association, May and June marked the first consecutive month increase in housing inventory since June-July 2022. Before May, the region saw 21 straight months of inventory decline, which pushed prices up.

And while the market inventory currently sits at less than 30% of what it was 10 years ago, many signs point to increasing inventory and some other highlights in the association’s data of North Shore markets provide key indicators.

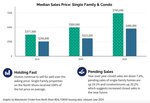

First, homes continue to sell for well over the asking price, and single-family properties received 104% of the list price on average according to data. Further, although year-over-year closed sales are down 7.8%, pending sales of single-family homes are up 29.1% and condominiums up 20.2% which, according to NSR, suggests good news for closed sales.

“Sellers are capitalizing on record prices in our area,” said NSR President Tyson Lynch. “This increased listing activity is supported by a 26% increase in new listings, which is good news for buyers as the supply of homes on the market in our region has increased by more than 34%. As summer continues, we hope this trend persists and brings us closer to a more balanced market.”

Manchester’s Margaret Maher Sheahan has seen many shifts in the local real estate market in her 18+ years as a real estate agent. The recent bump in inventory has been encouraging, she said, because it may quell some of the pressure that has built up over the last five years.

“Many of the transactions I’ve seen have been buyers who have lost out several times on homes where they put in solid, strong offers and these buyers just don’t want to lose out again,” said Sheahan. The result, she said, is homes continue to routinely sell over their asking price, and, in some cases, well over.

“I recently observed a transaction that went $300,000 over asking,” said Sheahan, who added that rents are at all-time highs, so the push to purchase remains despite current interest rates.

Ten years ago, 1,403 single family North Shore homes were on the market, and of those, 436 closed at a median price of $378,500. In the last year, inventory had plummeted to just 416 homes, with 291 selling at a median price of $745,000.

The condominium market tracked similarly, going from 516 listings in 2014 and 176 closings at a median price of $256,000 to the last year offering just 138 condos for sale on the North Shore, and 113 of those selling at a median price of $480,000.

The recent uptick in inventory is a welcome change for local agents like Susan McDermott of Gibson Sotheby’s, who sells from Rockport to Marblehead. McDermott said her office, based in Manchester, has been experiencing a steady climb in inventory. Today, her firm has 159 properties for sale compared to 111 this time last year. That’s a 48 percent increase, and that’s encouraging news for everyone.

“Buyers are hopeful and plentiful,” said McDermott. But, she said, expectations are relatively high and if sellers can meet these expectations, sales will be brisk.

“They’re seeking homes that are well priced and in excellent condition. These homes tend to go quickly and often with multiple offers, location still being the biggest draw. Properties needing attention are priced accordingly,” said McDermott. “We are closing a Hamilton property shortly that received 12 offers following an open house weekend which attracted over 70 parties.”

J. Barrett’s Julia Virden, who is both an agent in Essex and manages real estate all over Cape Ann, concurred that realtors face two major challenges—historically low inventory and high interest rates. Virden welcomes the changes in conditions, particularly with increased inventory that she says will make the local real estate market healthier in the end. And if the FED reduces interest rates it will be better still, she said.

“As buyer’s agents we are put under tremendous pressure to protect our clients’ best interests presenting competitive offers while at the same time avoiding putting their financial standing at risk,” said Virden. But, she said, “as listing agents we are, more than ever, pressured to educate our clients to price smart. I am hopeful the rest of the year will bring some normalcy with the help of interest rate correction(s) and, with it, increased inventory.”